Net Collection Ratio

Most ratios can be calculated from information provided by the financial statements. Financial ratios can. This number is known as the collection. Wondering what your practice is worth? Learn how the net collection rate can help you figure that out.

Don No 1hindi All Audio Songs. The, or AR, report is designed to analyze the of the. Using the discharge date of the patient account, the AR report calculates the length of time it takes for medical claims to get paid. Why is it important to know this information? If you see a patient today and in ten days the account has been paid in full and reflects a zero balance, it is clear that you are being paid for your services very quickly and your medical office is operating efficiently. However, if you see a patient today and six months from now the account still has not been paid, it is clear that it is taking way too long to resolve patient balances and your medical office is not operating efficiently. Example - Calculate Denial Rate. Photo courtesy of Joy Hicks Denial resolution is necessary for achieving financial goals for a medical office.

One important way to improve cash flow in the medical office is to track denials by calculating denial rates. Why is it important to know this information? Your goal is to get payment as quickly as possible. Taking a proactive approach to handling denials can improve AR days substantially.

In order to reduce denials, the medical office must calculate denial rates to see how well or poorly the office is performing. The formula for calculating denial rates is as follows: Denial rate equals the total dollar amount of denied claims divided by the total dollar amount of submitted claims.

Based on the volume of claims in your medical office, this can be calculated using monthly, quarterly, or yearly time frames. (Denial rate = Denied dollars/total dollars submitted) Denial rate can also be calculated by the actual number of claims submitted and denied. If you choose to use this method, the formula for calculating denial rates is as follows: Denial rate equals the total number of denied claims divided by the total number of submitted claims. Based on the volume of claims in your medical office, this can be calculated using monthly, quarterly, or yearly time frames. (Denial rate = # of Denied dollars/ # of total claims submitted). Example - Calculate Collection Rate. Photo courtesy of Joy Hicks Collection rates help the medical office determine how successful the office is in collecting receivables.

This rate tells a lot about the financial performance of the medical office how effective you are at collecting receivables. Why is it important to know this information? All collection efforts should be evaluated for efficiency. The collection rate is different because it actually shows the correlation to the portion of collectible receivables to the portion of actual collectible receivables collected. Any collection rate less than 100 percent means there is room for improvement.

The formula for calculating collection rate is as follows: Collection rate equals total dollars received divided by total expected receivables (collection rate = total dollars received/total dollars expected) Total expected receivables is calculated by subtracting the contractual adjustment amounts from the total charges.

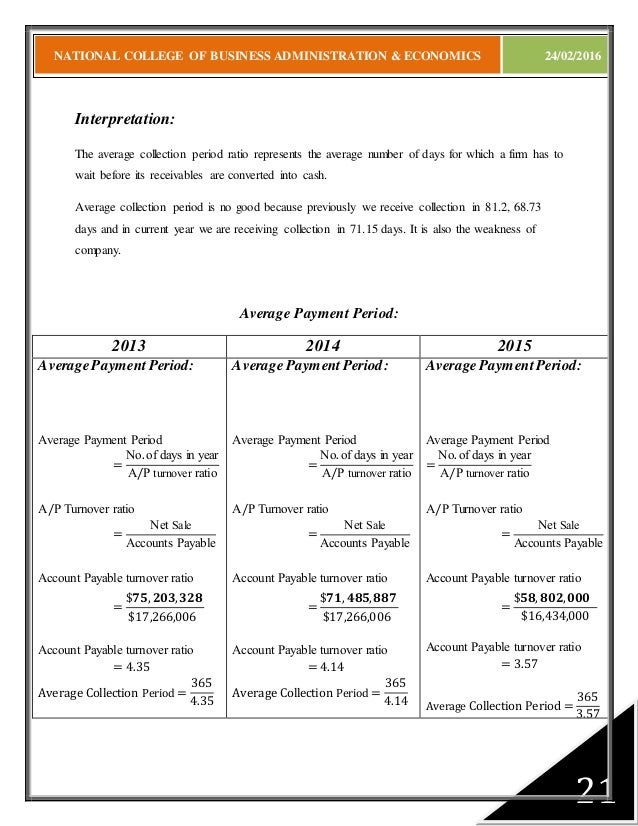

Three Parts: Businesses both large and small often sell their product to their customers on credit. Credit sales, unlike cash transactions, must be carefully managed in order to ensure prompt payment. Mismanaged accounts can lead to slow or late payments and default. One way to keep track of credit sales is to analyze the related financial ratios, such as the average collection period. Learning how to calculate the accounts receivable collection period will help your business keep track of how quickly payments can be expected.

Determine net credit sales. Net credit sales equals all of the sales on credit less all sales returns and sales allowances. Sales on credit are non-cash sales where the customer is allowed to pay at a later date. Sales returns are credits issued to a customer due to a problem with the purchase. Sales allowances are reductions in price granted to a customer due to problems with the sales transaction. If a company grants a large amount of credit, even to customers with a poor credit history, its net credit sales will be higher.

• Use this equation: sales on credit – sales returns – sales allowances = net credit sales. Calculate the average accounts receivable balance.

Use the month-end accounts receivable balance for each month in the measurement period. This information is always recorded on the company’s balance sheet. For seasonal businesses, the best practice is to use 12 months of data to account for the effects of seasonality. Rapidly growing or declining businesses, on the other hand, should use a shorter measurement period, such as three months.

New Bells And Whistles Keygen - Free Download Torrent. Using 12 months of data would understate the average accounts receivable for a growing company and overstate it for a declining company. Calculate the accounts receivable turnover ratio.

This is a company’s annual net credit sales divided by its average balance in accounts receivable for the same time period. This calculation tells how many times a company’s accounts receivable turns over. • For example, suppose a company has $730,000 in net credit sales and an average balance in accounts receivable of $70,000. Use the equation $730,000 / $80,000 = 9.125 This means that the company’s accounts receivable turns over about 9 times every year.